Date of Withdrawal: 01-Jan-2014

Plan No. 802

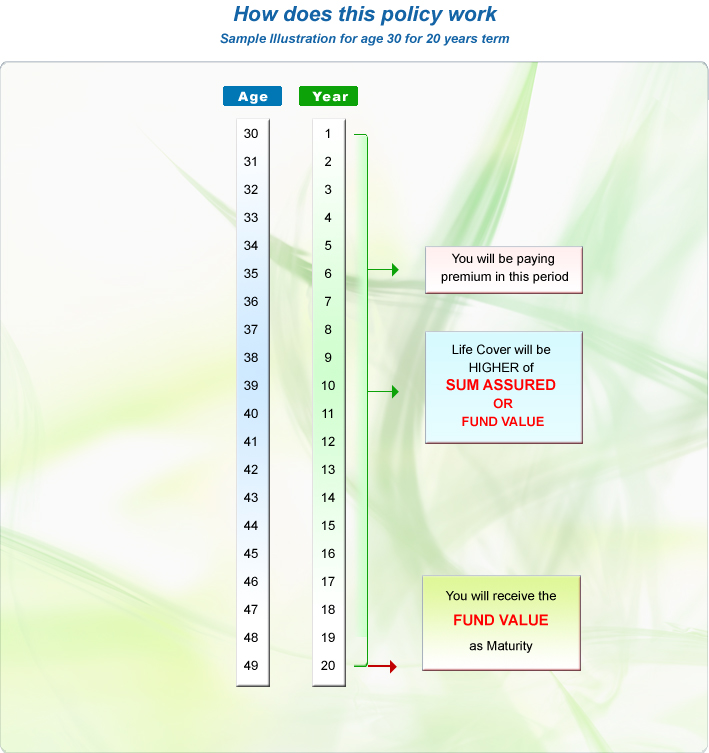

- Endowment Plus Plan is Unit Linked endowment plan where in you get the liberty to choose the fund to invest as per your risk appetite and also get Life Cover.

- Funds available under this plan are Bond, Secured, Balanced and Growth fund.

- A policyholder can partially withdraw the units at any time after five policy years.

- Loan can be availed after completion of 3 policy years.

- Premiums can be paid in yearly, half yearly, quarterly and in monthly (ECS) installment OR in single installment.

- Policy can be surrendered after completion of 5 years with no surrender charge.

- Policyholder can switch between any fund types during the policy term. 4 switches will be allowed free in a policy year.

- Policyholder has a option to enhance the risk cover by choosing the Double Accident benefit rider and the Critical Illness Rider.

- On death of the policyholder, the nominee will be eligible to get higher of Sum assured (minus partial withdrawal if any done during last two years) or the Fund value of units.

- In case of maturity the policyholder will get amount equal to the Fund value of the units.

- Maturity returns can be amplified by exercising ‘Settlement Option’, through which returns can be taken in installments.

- Enjoy tax benefit under section 80CCE.

| Eligibility Criteria | ||

|---|---|---|

| Min. | Max. | |

| Age | 7 | 60 |

| Term | 10 | 20 |

| Sum | 35,000 | No Limit |

| Premium Modes | Yly, Hly, Qly, Mly, Single | |