Plan No. 933

- Jeevan Lakshya is the ideal plan to protect your goals & needs as this plan offers the regular income to the family in case of an unfortunate event

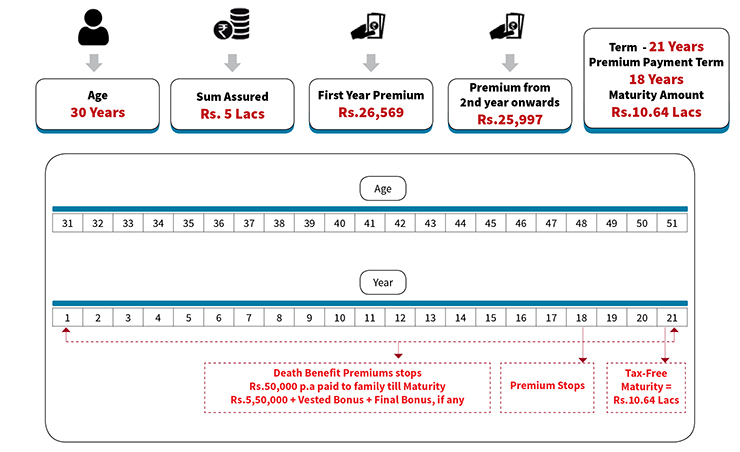

- In case of any unfortunate event premium ceases & Annual Income Benefit is paid to the family every year till maturity which is 10% of Sum Assured. On Maturity, 110% of Sum Assured is paid along with vested Bonus & final bonus, if any

- The benefits under this plan are tax-free

- This plan has an option of choosing the Accidental Life cover, Disability Benefit & Critical illness cover

- This plan also has the option of taking the Maturity proceeds in instalments as the policy-holder can choose the no of year as 5, 10 or 15.

- In a similar way, the policyholder also has the option of choosing the death benefit in instalments

- LIC also offer the discount in the premium in case the mode of payment is Yearly

- The loan is also available to the policyholder after the completion of 2 years of the policy

- Settlement option available on Maturity and Death in Installments of 5,10 or 15 Years

How Does This Policy Work

Sample illustration

| Eligibility Criteria | |||

|---|---|---|---|

| Min. | Max. | ||

| Age | 18 Years (Last Birthday) | 50 Years (Nearer Birthday) | |

| Policy Term | 13 Years | 25 Years | |

| Premium Payment Term | Policy Term - 3 Years | ||

| Basic Sum Assured | Rs.1 Lac | No Limit | |

| Maximum Maturity Age | 65 Years (Nearer Birthday) | ||

| Rider | LIC’s NEW CRITICAL ILLNESS BENEFIT RIDER(CIR) | ||

| Rider | LIC's ACCIDENTAL DEATH AND DISABILITY BENEFIT RIDER | ||

| Rider | LlC's ACCIDENT BENEFIT RIDER | ||

| Rider | LIC's NEW TERM ASSURANCE RIDER (TR) | ||